the Beatings Will Continue Until Morale Improves

Get Chartbook Here (note that we shifted this week to Dec Quarterlies)

Hi All,

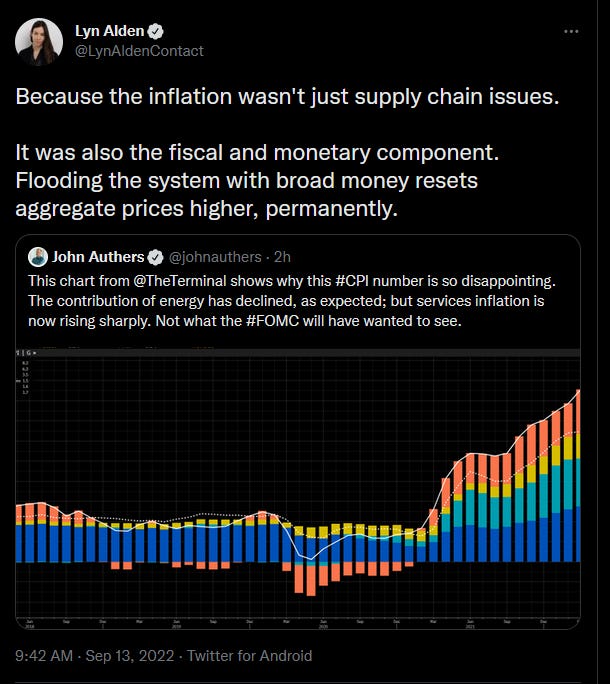

Honestly, I think that gets funnier every time I read it. It is a clear reminder of how disconnected directors can get from the directed. Today's CPI number was the beatdown. Of course, no one thinks that this figure is forward looking. Everyone simply had to go back to their interest rate forecasts and jam in more action from the Fed. After all, Powell made clear he is ready to destroy demand for goods & services since the Fed cannot create more supply. I question the wisdom of this exact path forward but it does not matter. I will channel Kevin Muir and remind you that opinions don't make you money. You have to trade the market as it is, not as you want it to be.

To that end, let's remember back to 2020 or so, when there would be regular complaints that ran something like "I can't make any money, the central banks have rigged the game so that stocks only go higher." Uh, that was the trade (to be clear, I missed it). Now, we have the reverse. as longs are saying "I can't make any money, the central banks have rigged things to tighter financial conditions." Yah. Long positions in every asset class are facing headwinds. Well, except the dollar.

I don't think a one-off (here):

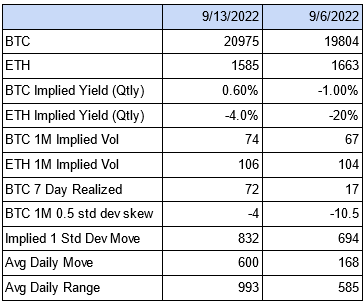

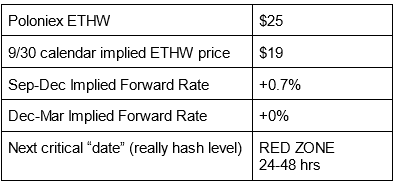

Merge by the numbers:

From the above it is worth noting that ETHW has dropped appreciably (more so than the calendar spread has moved in). Sep-Dec is now positive (from negative) and Dec-Mar is now flat (from positive). Also worth noting that March futures should be listed on FTX and other venues within the next week. My expectation is that we should see as a guide around -$11 per 3 months of basis or each 3 month quarterly should be $11 less than the prior. This is due to implied staking. Also, when you check out the chartbook, note that ETH implied yields are all about the dollar price related to ETH PoW fork. All calendars on Deribit are around -$15 so the yields look very, very high up front.

There is no doubt volatility is high in ETH options. With an almost $200 range today, it is paying for itself. My personal opinion prior to this move was that if the Merge goes well it will be a dud event. If it goes haywire, then things go wacky fast. In light of that, I prefer puts to calls. And in light of the vol being unsustainable but with clear potential for movement, I prefer selling calendars. That is, sell longer dated volatility meaning October or longer (one month goes for long dated in crypto) and holding short term options against. This provides short vega and long gamma. Remember that there is no free lunch and this situation is a lot of risk. I have no idea if it is right for you. So this is not advice.

We have a lot going on today here at Digital Gamma central, so I'm going run through a lightning round format:

-

CME launches ETH options on futures. I'm both excited and not. On the one hand, that's great, but clearly the traction on BTC options has not been stellar despite being an active futures contract.

-

Treasury market liquidity is an issue. Harald Malmgren (father of Pippa) is a great follow and here he retweets some quoted comments from BofA on structural problems in the US Treasury market. Why is this important? The US Treasury bond market, along with the US Repo market, is "the source" for all of global finance. As I tweeted

-

Help me with this because this is not where I'm focused. This is from Blockworks Daily and it does not seem like an encouraging sign.

Things I'm reading / listening to / interested in:

-

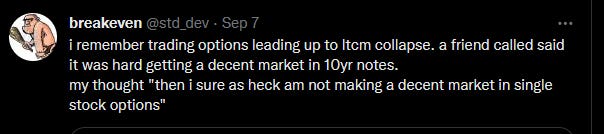

It's probably nothing. Quoth the statistician

-

Crypto Vol and hashrate from Block Scholes / Deribit

-

Genesis Vol interviews Toby Chapple of ZeroCap

-

Given the CPI figure, worth a re-read of the Kevin Muir's take on MMT from 2019. FYI he is pay only but you can also find him on the Market Huddle. Beers, markets, and Canadians. What could be better, eh?

Tell me (how) I'm wrong,

Ari

DISCLAIMER: Do your own research. Nothing herein is investment or trading advice. All information here is given on a best efforts basis and there is no guarantee of accuracy. Digital Gamma or the author may or may not have positions in the assets or their derivatives mentioned herein.

Source: https://digitalgamma.substack.com/p/the-beatings-will-continue-until

0 Response to "the Beatings Will Continue Until Morale Improves"

Post a Comment